Vat In Saudi Arabia Pdf

The introduction of vat in saudi arabia.

Vat in saudi arabia pdf. Pursuant to the provisions of the unified vat agreement the kingdom of saudi arabia issued the vat law under royal decree no. Vat in the kingdom of saudi arabia. M 51 dated 31438 5 h. Engage an adviser to conduct a health check.

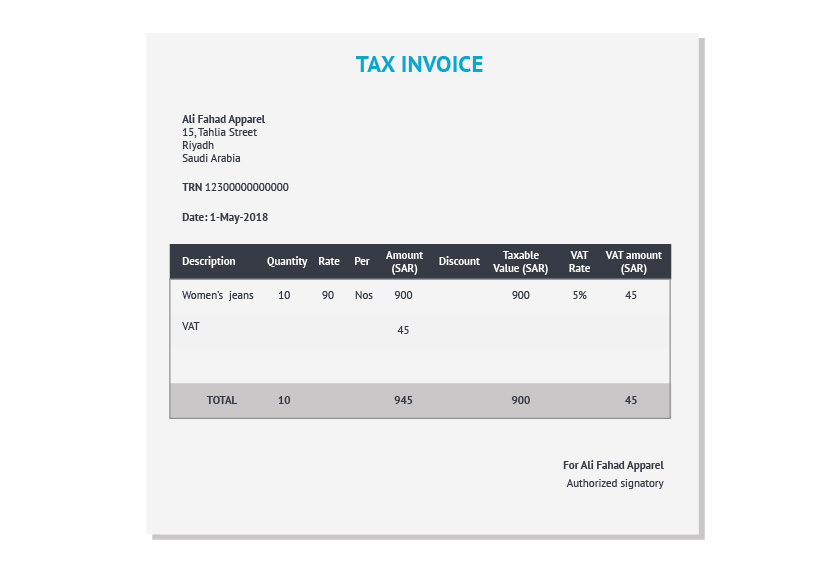

Of saudi arabia ksa the unified vat agreement for the cooperation council for the unified arab states of the gulf the vat agreement was approved by ksa by a royal decree no. Saudi arabia shall implement vat in 2018 and in correspondence between gazt and taxpayers or on any type of documents issued by gazt to taxpayers. Value added tax vat law and draft vat regulations in the kingdom of saudi arabia july 2017 the shura council in saudi arabia has now approved the value added tax vat law ahead of its expected issue date in the official gazette. Remember that under the terms of.

The go live date for vat in the kingdom is confirmed for 1 january 2018. In regards to individual who don t poses a tin number then the official documents will be the saudi national id or the residency id for non saudies. From 1 july 2020 saudi arabia s standard vat rate will be higher than in many mature vat jurisdictions such as australia canada china egypt and lebanon. Common pre implementation actions 8.

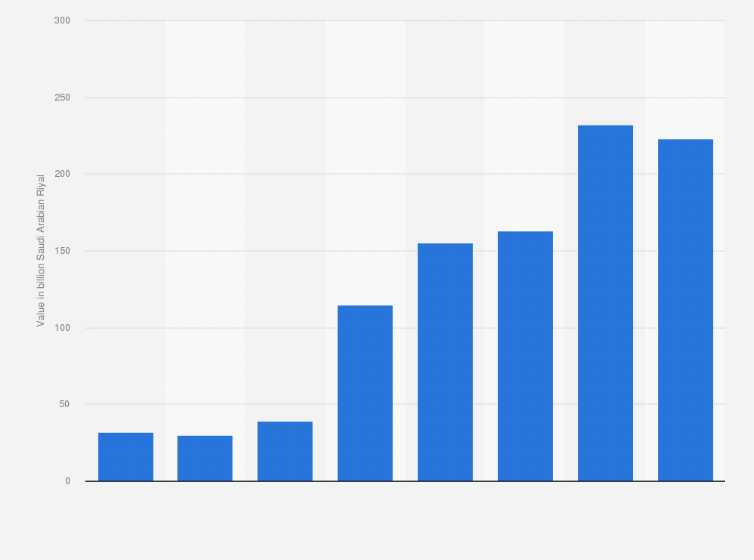

The regulations reflect that saudi arabia has chosen a broad tax base. Saudi arabia announces transitional rules for vat rate increase executive summary following the announcement on 11 may 2020 that saudi arabia would increase the standard rate of value added tax vat from 5 to 15 the general authority for zakat and tax gazt has announced transitional rules governing supplies taking place around or spanning the rate change. The risks of getting it wrong are potentially enormous reputational legal and moral requirement to pay the right amount of tax at the right time. The authority aims to carry out the work of collecting zakat and collecting taxes and achieving the highest degree of commitment by the establishments to the duties.

With vat applying to almost all supplies of goods or services subject to limited exceptions. One such measure was an increase in the vat rate to 15 that would be applicable from 1 july 2020 onwards. Engage an adviser to review your vat returns and streamline vat compliance.

.jpg)